The Crestbridge Connection: FTX, the CFTC, LedgerPrime, LedgerX, and ApeCoin DAO

LedgerX is scheduled for final auction today. Its parent company has a strange connection to ApeCoin DAO. What are the implications of the LedgerX sale for the future of cryptocurrency regulation?

Update: According to a March 6 filing, the LedgerX sale and hearings were rescheduled. I’ll provide further information after reading the filings. The twists keep coming. (Here is my screenshots of the filing.)

Today, March 7th, will have massive regulatory implications for the future of cryptocurrency markets.

LedgerX LLC has been described as one of the most desirable assets involved in FTX’s bankruptcy proceedings. Today, it is scheduled to receive the final bids in its auction.

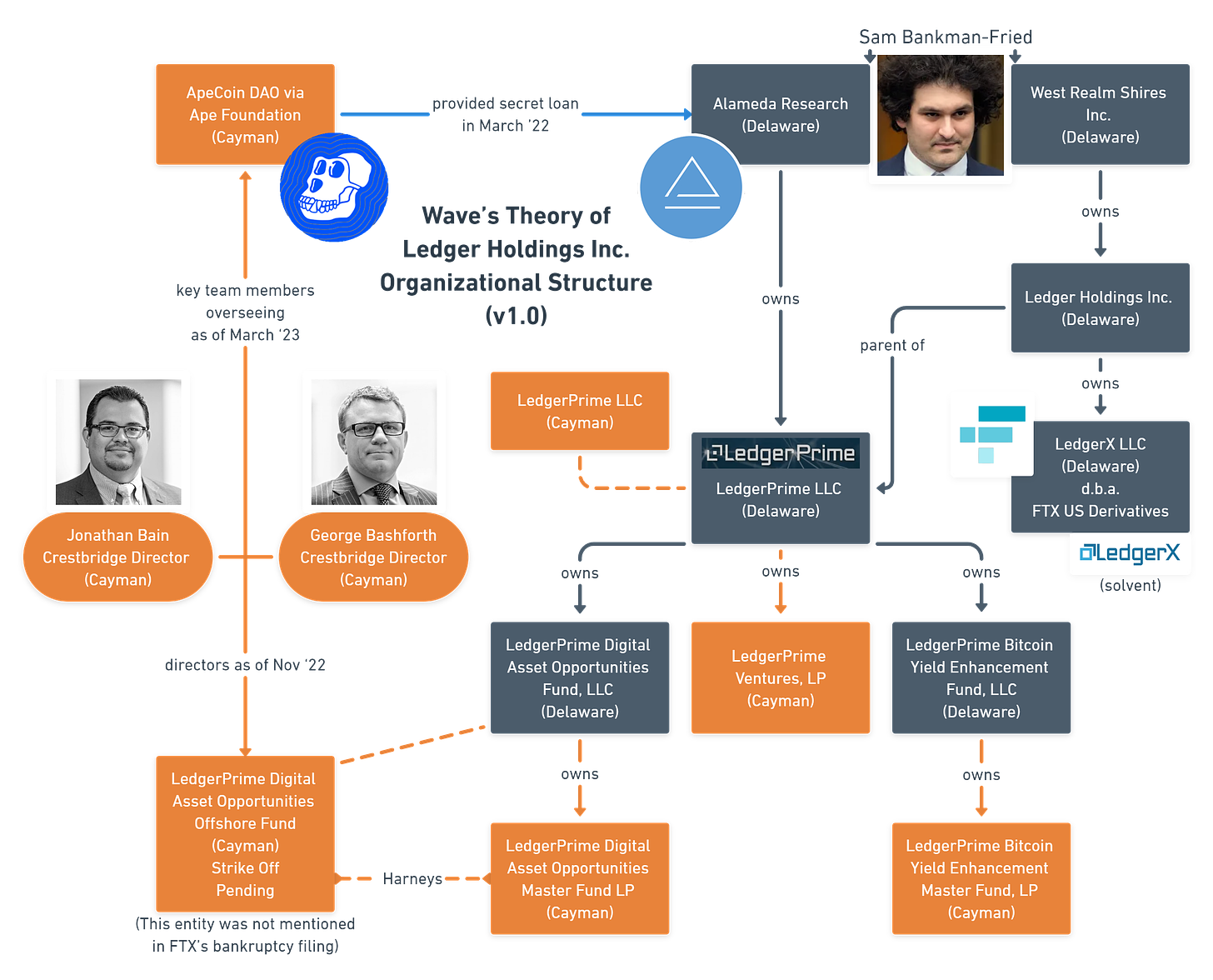

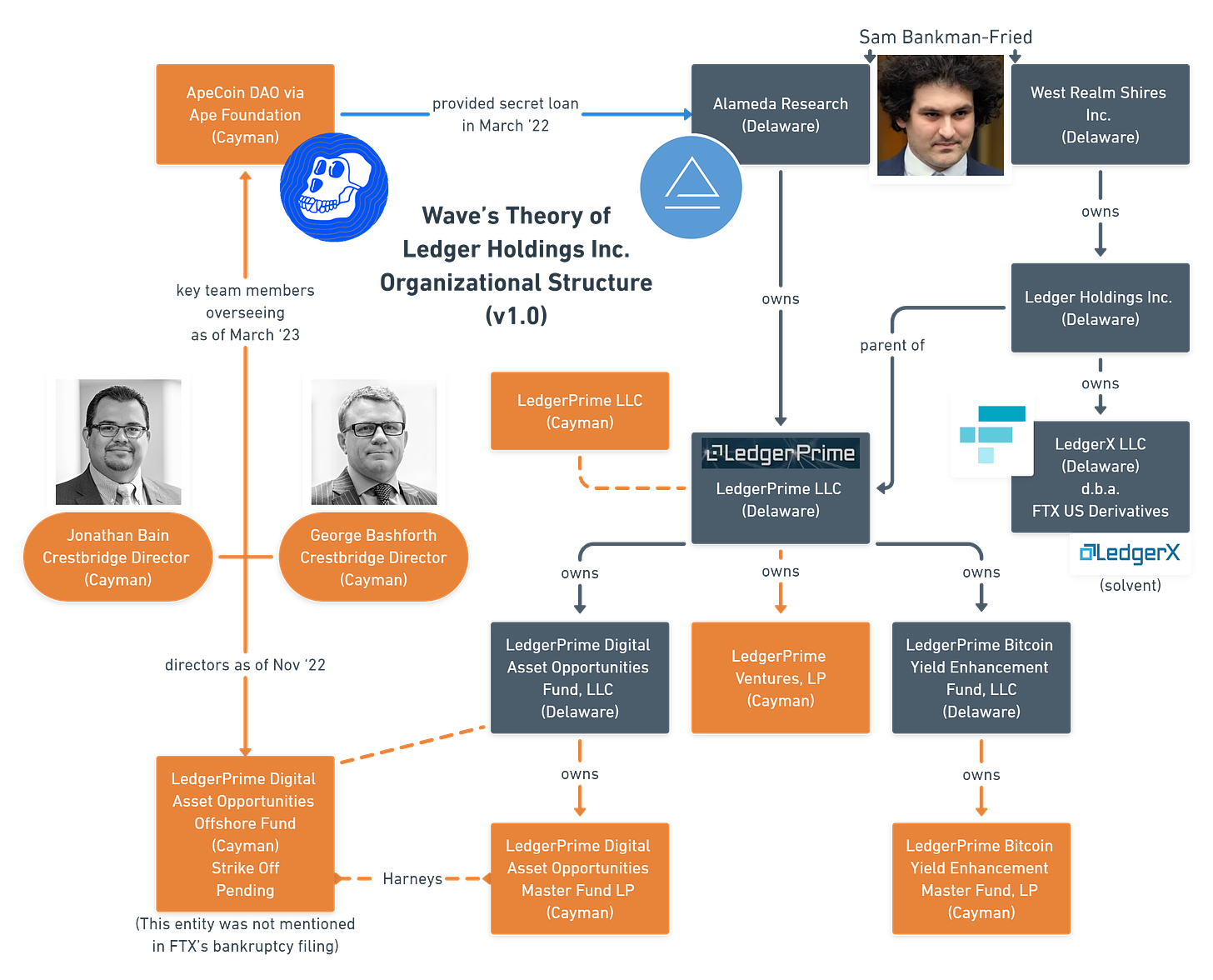

LedgerX is a digital currency futures and options exchange and clearinghouse owned by Ledger Holdings Inc. Ledger Holdings is also the parent company of LedgerPrime, a quantitative digital asset investment fund based in New York and led by CIO Shiliang Tang.

FTX acquired Ledger Holdings in 2021. LedgerX LLC became known as “FTX US Derivatives.” The role LedgerPrime plays has been more opaque.

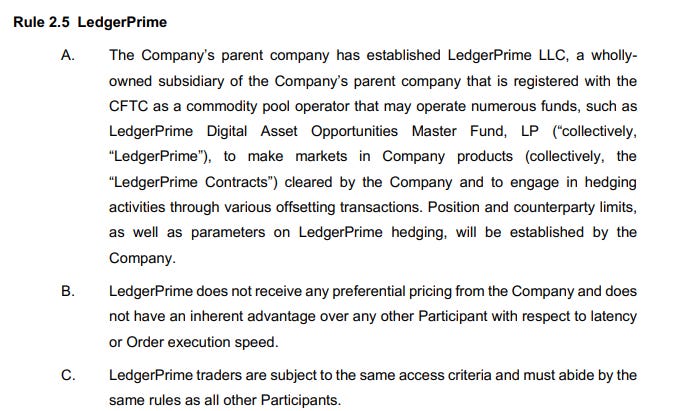

LedgerX’ LLC’s rulebook (reproduced below) gives some insight into the relationship between LedgerX and LedgerPrime.

LedgerX’s rulebook establishes a few critical pieces of information:

LedgerPrime LLC is “a wholly-owned subsidiary of [Ledger Holdings Inc.] that is registered with the CFTC as a commodity pool operator that may operate numerous funds”

These numerous funds are known collectively as “LedgerPrime”

One example of those numerous funds includes “LedgerPrime Digital Asset Opportunities Master Fund, LP”

The purpose of these funds is to “make markets in [LedgerX] products … cleared by [LedgerX] and to engage in hedging activities through various offsetting transactions”

LedgerX LLC determines “position and counterparty limits, as well as parameters on LedgerPrime hedging”

Including the Digital Asset Opportunities Master Fund, LedgerPrime is connected to at least five separate Cayman entities, shown on the chart above.

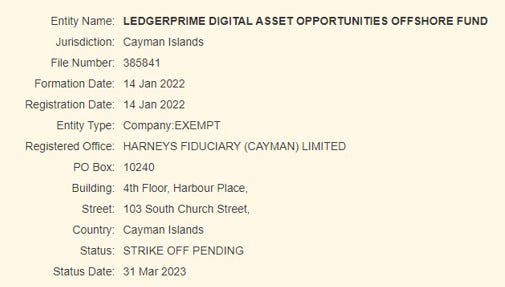

Most of these entities were included in the petitions, but there is one that did not appear anywhere on FTX’s bankruptcy list: the LedgerPrime Digital Asset Opportunities Offshore Fund.

To my surprise, it turns out that LedgerPrime’s Offshore Fund shares some connective tissue with ApeCoin DAO.

ApeCoin DAO’s New Overseers

Previously, I reported via Surfing the Waves about a series of secret transfers of ApeCoin that occurred before the token originally launched in mid-March 2022. The previous ApeCoin DAO administrator, Cartan Group, claimed that these transfers represented loans to “market makers.”

Alameda Research was the recipient of one of these transfers. Wintermute received two larger, separate transfers.

These loans came due on February 18, almost three weeks ago. There have been no updates provided by the previous administrator or the new administrator regarding the repayment of any loans.

I have been in contact with Wintermute officials. They will not offer public comment or even acknowledge the transfers.

Last month, on the back of assorted complaints about Cartan Group, ApeCoin DAO elected new administrators to run its Cayman-based APE Foundation, which facilitates decision making for the DAO.

Only two vendors were offered as choice: 1) Webslinger or 2) a consortium of Autonomous, Provenance, and Lemma. Webslinger, as it turned out, was also working in conjunction with other organizations. Yet, the ballot included only Webslinger’s name.

To some controversy, the working group arranged to steward this transition recommended Webslinger as the preferred choice, citing a gap in work experience between the two vendors.

Webslinger won by a landslide. Their competitor won less than 4% of the vote.

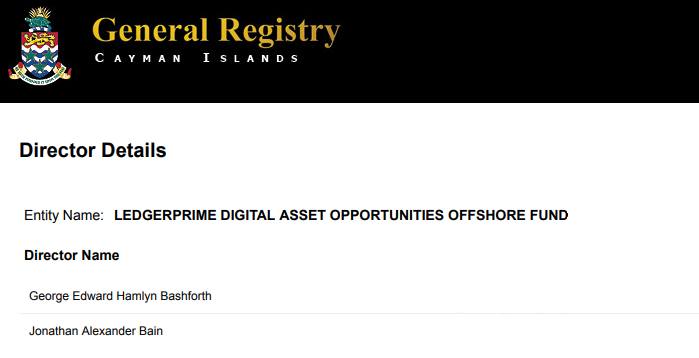

Inside Webslinger’s written proposal, another name appeared: Crestbridge Cayman Limited. Crestbridge is represented on the new ApeCoin administrative team by its Cayman Islands based directors: Jonathan Bain and George Bashforth.

Bain spoke on behalf of Crestbridge during the election meetings. At one point Webslinger’s Twitter profiles became a point of contention. Bain’s Twitter account was created in 2009, but his profile shows only two tweets in total. Both are corporate retweets from over seven years ago.

George Bashforth’s Twitter account isn’t much more inspiring. While Bashforth is a bit more active on Twitter, his account is awash in a mixture of boomer spam and weird retweets pumping up altcoins.

From the election meetings, it was difficult to get a sense of their true experience or credentials — or even just their basic personalities. These men were elected to oversee the direction of one of the most influential DAOs in the entire cryptocurrency space. Yet they had no social media presence or evidence of authentic engagement with any digital communities.

Seeking to learn more about the new ApeCoin DAO overseers, I identified a bizarre connection between Bain, Bashforth, and LedgerPrime.

According to a third party report obtained by Surfing the Waves, as of November 12, 2022, Bain and Bashforth were the directors of the LedgerPrime Digital Asset Opportunities Offshore Fund.

According to reports I personally pulled, the LedgerPrime Offshore Fund is currently designated as strike-off pending, a winding up process generally used as an alternative to voluntary liquidation.

I pulled another report to check the legal addresses of both the LedgerPrime Digital Asset Opportunities Master Fund LP and the LedgerPrime Offshore Fund. Both are registered via Harneys Fiduciary. That both companies are registered via the same fiduciary firm seems to confirm a close legal relationship.

Learning that the new administrators of ApeCoin DAO were previously the directors for LedgerPrime’s Offshore Fund during the reign of FTX, I took a deeper look at the historical regulatory developments over the past few years between Ledger Holdings Inc. and FTX.

Feel free to skip the following section if you are already familiar with this history. My analysis is in the final section.

A Brief Regulatory Survey of Ledger Holdings Inc. and the CFTC

In 2015, the Commodity Futures Trading Commission determined that “virtual currencies” meet the definition of a “commodity.”

The CFTC assumed regulatory oversight over virtual currencies such as Bitcoin under its authority granted via the Commodity Exchange Act.

In 2017, LedgerX registered with the CFTC as a designated contract market, swap execution facility, and derivatives clearing organization. In 2019, LedgerX also gained regulatory approval to trade bitcoin futures settled in digital currency.

In April 2020, former CFTC associate director Brian Mulherin joined LedgerX as chief legal advisor. In June 2021, former CFTC economist Julie Schoening joined LedgerX as Chief Risk Officer. Schoening and Mulherin worked closely together in developing proposals for the CFTC.

In August 2021, FTX announced an acquisition of Ledger Holdings Inc — the parent of LedgerX LLC and LedgerPrime.

On August 31, 2021, FTX CEO Sam Bankman-Fried described the acquisition as “one of the most exciting announcements we’ve ever had” and expressed excitement “to work with the CFTC on innovating in the US crypto derivatives space in a regulated, understood manor [sic].”

On the day of the LedgerX acquisition announcement, FTT was trading under $50. Over the next week, FTT soared to a new all time high, peaking on September 8, 2021, around $78.

FTX’s acquisition of Ledger Holdings was finalized in late October 2021. LedgerX became known as “FTX US Derivatives.”

In the meantime, FTX announced a fresh injection of capital — $420 million via 69 investors. SBF cited recent growth as well as FTX’s approach to regulation as reasons for investor confidence.

During a CoinDesk interview on October 27, Bankman-Fried again highlighted how LedgerX gave FTX a unique entrance into the US crypto derivatives exchange marketplace.

“We would be really excited to work with the CFTC on being the first one there,” he said.

Over the next few months, FTX US President Brett Harrison boasted about LedgerX’s projected influence in conjunction with the CFTC. He made it clear that FTX’s ambitions went far beyond cryptocurrency.

“Our goal is to be the US-regulated exchange and platform where you can trade everything,” Harrison tweeted on October 6th, 2021. “Our acquisition of LedgerX brings us several large steps closer to this.”

Former CFTC Commissioner Mark Wetjen joined FTX in November 2021 as head of policy and regulatory strategy. Harrison was visibly enthralled to work with Wetjen and saw him as a key player in the legal and regulatory path to “the future of US derivatives.”

More former CFTC economists joined FTX along with Wetjen: Jim Outen joined LedgerX as Chief Economist and John Rothenberg joined LedgerX as Deputy Chief Risk Officer.

On August 3, the “Digital Commodities Consumer Protection Act of 2022” sponsored by Democrat Senator Debbie Stabenow was introduced to the US Senate. The bill received input from both CFTC and FTX representatives, including Wetjen. The bill would essentially propose placing the CFTC in charge of overseeing crypto exchanges.

On September 1, 2022, FTX announced that former CFTC Commissioner Jill Sommers joined the FTX US Derivatives/LedgerX Board of Directors.

On October 13, CFTC Chair Rostin Behnam spoke at a conference, exhorting FTX’s proposal for disintermediated futures trading as a potential “evolution of market structure, innovation and disruption.” Cutting out the middleman would open up derivatives markets for retail investors, according to Benham.

If you aren’t familiar with how Behnam and Bankman-Fried cultivated their close-knit relationship, this Washington Post article extensively covers how FTX aggressively pursued power in Washington and captured extensive influence over the CFTC.

The Solvency of LedgerX

On November 11, 2022, FTX filed for bankruptcy protection.

Ledger Holdings Inc, LedgerPrime LLC, two of LedgerPrime’s LLCs, and three of LedgerPrime’s Cayman companies all filed petition for relief in FTX’s bankruptcy case.

The LedgerPrime Offshore Fund was not included among these entities.

The next day, November 12th, Seeking Alpha reported that “LedgerPrime plans to return all outside capital to investors as part of its transition to being a part of a family office.” The article implied that LedgerPrime intended to “move out of FTX and become a subsidiary of Alameda Research.” Seeking Alpha also cited a source that claimed LedgerPrime had “assets under management of $300m to $400m.”

Meanwhile, Financial Times published a report, commenting on FTX’s balance sheet: “The second-biggest liquid asset was $200mn of cash held with Ledger Prime, a crypto investment firm owned by Alameda.”

On November 17th, when describing FTX’s corporate organization, John J. Ray III identified LedgerX and the FTX US Derivatives as belonging to the West Realm Shires Inc. Silo, aka the “WRS Silo.”

“Based on the information that I have reviewed at this time, LedgerX is solvent,” wrote Ray.

On November 17, in the fallout of FTX’s collapse, LedgerX CEO Zach Dexter gave public assurance that operations were running smoothly: “LedgerX LLC has not filed for bankruptcy; customer assets are safe and accounted for; we are solvent and well-capitalized.”

The same day, Kristin Johnson, commissioner at the CFTC stressed that LedgerX was excluded from the bankruptcy filing and that the CFTC had “boots on the ground.”

On December 1, 2022, Behnam appeared before the U.S. Senate Committee on Agriculture, Nutrition, and Forestry. Behnam appealed to uphold LedgerX as an example of successful regulation, noting it was one of the few FTX entities that remained solvent in the wake of FTX’s collapse.

“The CFTC has been in near-daily contact with LedgerX as well as the third-party custodians it uses to hold cash and digital assets,” said Behnam.

Commissioner Johnson appeared for a Bloomberg interview on January 27, 2023. She discussed the sale of LedgerX alongside the CFTC’s role in the sale. Johnson took a more measured and “thoughtful” approach in discussing LedgerX.

Johnson described the CFTC’s focus “on the auction taking place even now with respect to that entity, the indications of interest, the obligations that will be put upon any potential bidder or buyer and the extent to which that bidder or buyer might be prepared to conform and adopt a culture of compliance with our regulatory framework.”

She highlighted the CFTC’s lack of statutory authority to interrogate the transaction, stressing consideration of how the acquiring entity’s behavior will impact LedgerX. Johnson cited the FTX/West Realm Shires acquisition of LedgerX itself as an example to heed caution.

“As of now,” she spoke flatly, “we [the CFTC] have no approval authority with respect to any element or aspect of the acquisition of Ledger X. The only obligation in the context of an equity sale is notice.”

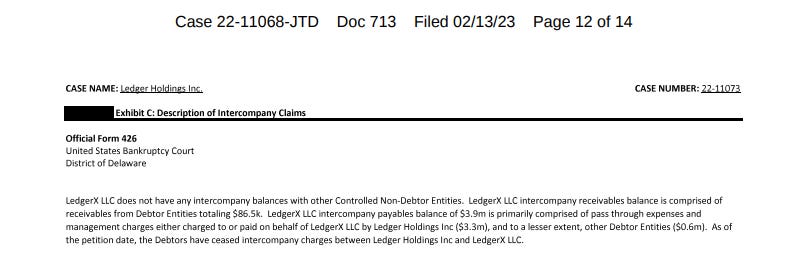

A filing on February 13, 2023, showed LedgerX LLC’s intercompany payables balance of $3.9 million was “either charged to or paid on behalf of LedgerX LLC by Ledger Holdings Inc ($3.3m), and to a lesser extent, other Debtor Entities ($0.6m).”

In January 2023, a Delaware bankruptcy judge approved bid procedures to sell off independent subsidiaries, including Ledger X.

The final auction for LedgerX is scheduled for today, March 7, 2023, followed by a sale hearing scheduled for March 13.

Bloomberg reported that “crypto players like Blockchain.com, Gemini and Kalshi were said to be among those interested.” Coinbase and Crypto.com were also mentioned by the CFTC as potentially interested parties.

Andrew Vara, the trustee representing the Department of Justice in FTX’s proceedings, objected to the plans to sell LedgerX along with three other businesses back in January. Yesterday, March 6, Vara’s team filed an appeal against the judge’s denial of a motion to appoint an independent examiner.

I spoke with Michael Grace and Nathaniel Nussbaum, partners at Perella Weinberg, the firm orchestrating the sale process of LedgerX. Neither would discuss any further details about the auction or the bidders.

“We don’t talk to journalists,” Grace told me in a gruff tone.

He attempted to hang up, but our line stayed connected. I laughed as I listened to him shuffle around papers for the next minute before I hung up.

Analysis: The CFTC Needs to Provide Regulatory Transparency Around LedgerPrime

The CFTC seems to be outright ignoring the shadow of LedgerX — a.k.a LedgerPrime.

If the CFTC assumes regulatory oversight over LedgerX, the same is true of LedgerPrime — just as stated in LedgerX’s compliance manual.

And if it’s true that the CFTC assumes regulatory oversight over LedgerPrime, then there are serious questions to be asked about how the CFTC regulates these corporate structures:

How does the CFTC ensure LedgerPrime operates responsibly when market making for LedgerX products?

How does the CFTC oversee appropriate counterparty due diligence? How are conflicts of interest appropriately disclosed?

Why does LedgerPrime LLC have its own Cayman company with an identical name?

Why hasn’t the LedgerPrime Offshore Fund been publicly acknowledged by regulators? What purpose did it serve?

What protections did the CFTC create to avoid commingling of assets or improper relationships with affiliate organizations?

The answers to these questions are critically important to understanding how LedgerPrime collectively operated under FTX, how it interacted with LedgerX, and how the CFTC exercised its regulatory powers during a long period of complacency around FTX.

Essentially, what prevented evasion of regulatory standards via these Cayman companies? What would prevent such activities in the future?

I hope the CFTC works urgently to make information about the regulation of LedgerPrime accessible and transparent to the public.

After all, you never know what acquiring company might end up winning the LedgerX auction and running the show. There are more important considerations than the rock bottom dollar price at which LedgerX is sold.