Wave's Theory: A Visual Guide to the Underbelly of FTX, Yuga Labs, and the CFTC

Scraping the tip of the iceberg with a visual take on the complex network of overlapping relationships between cryptocurrency companies, U.S. regulators, and their (sometimes shared) legal firms.

Today, a visual resource: “Wave’s Theory.”

I recommend viewing the high-resolution version here.

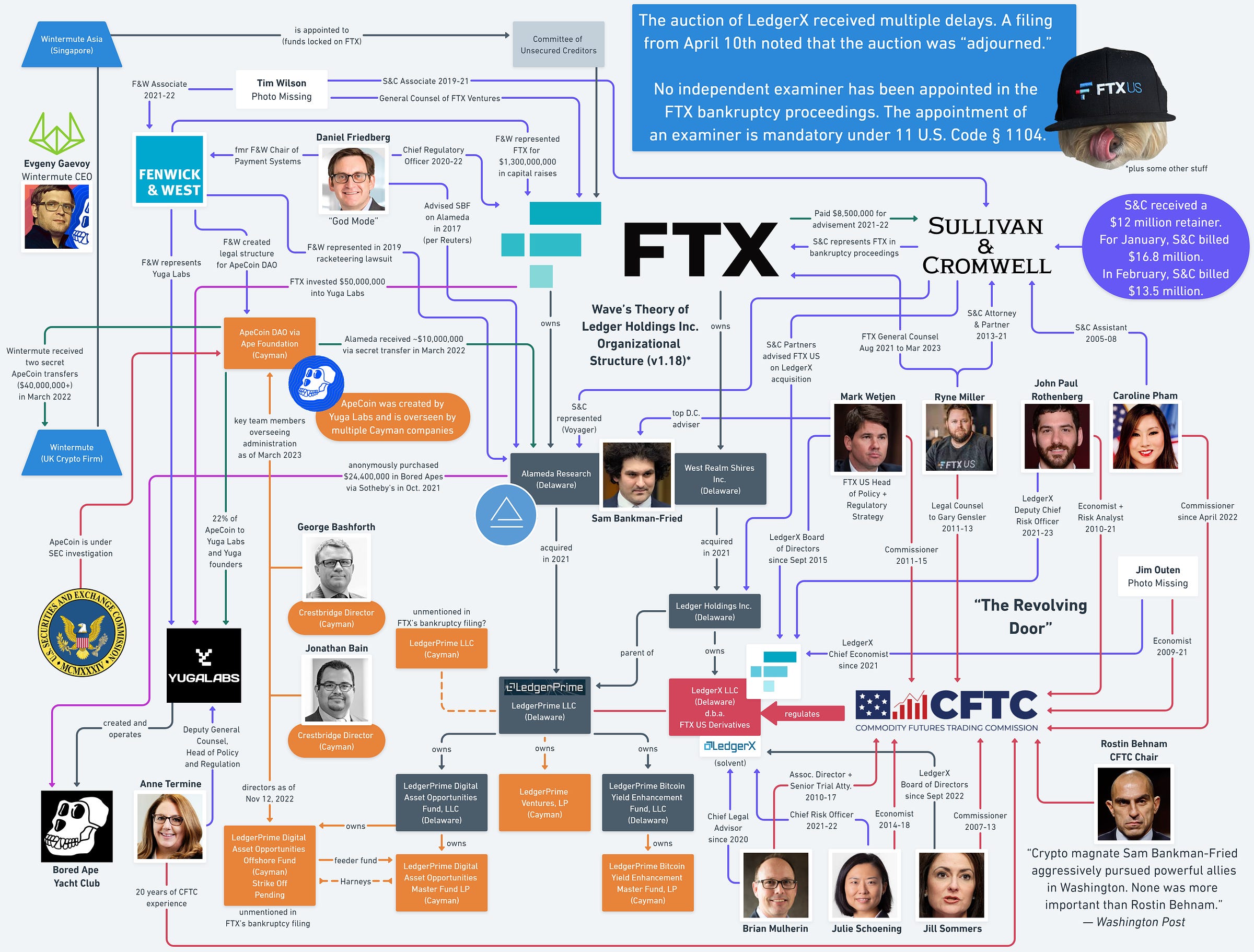

Originally, I created this chart to help visualize the various Cayman entities associated with Ledger Holdings — which is why the full title is “Wave’s Theory of Ledger Holdings Inc. Organizational Structure.”

A smaller version of the chart appeared in my article “The Crestbridge Connection” in which I revealed that two of the new administrators of ApeCoin DAO were also the directors of the LedgerPrime Digital Asset Opportunities Offshore Fund at the time of FTX’s collapse. This particular fund was previously undisclosed in FTX’s bankruptcy filing, although it appeared in a later filing (see docket #861) after my initial story.

I created this extended version to visualize and start to contextualize how the stories told on Surfing the Waves are interconnected. The chart reflects other reporting I’ve published, including the secret ApeCoin loans to Alameda and Wintermute and FTX’s record-breaking auction win at Sotheby’s.

The individuals, organizations, and events represented here are just a small fraction of what and who is involved. Many other key players and interactions will be making appearances that will require the chart to expand even further.

Please reach out to me if you notice any potential errors, think of a suggestion, or have a question about the sourcing of information.

Does looking at this chart make you want to know more?

If so, you’re in the right place.

First, let’s go back to Sotheby’s. “Low Down” is coming soon: