Who Run It: A Brief History of LedgerX, FTX, and MIAX

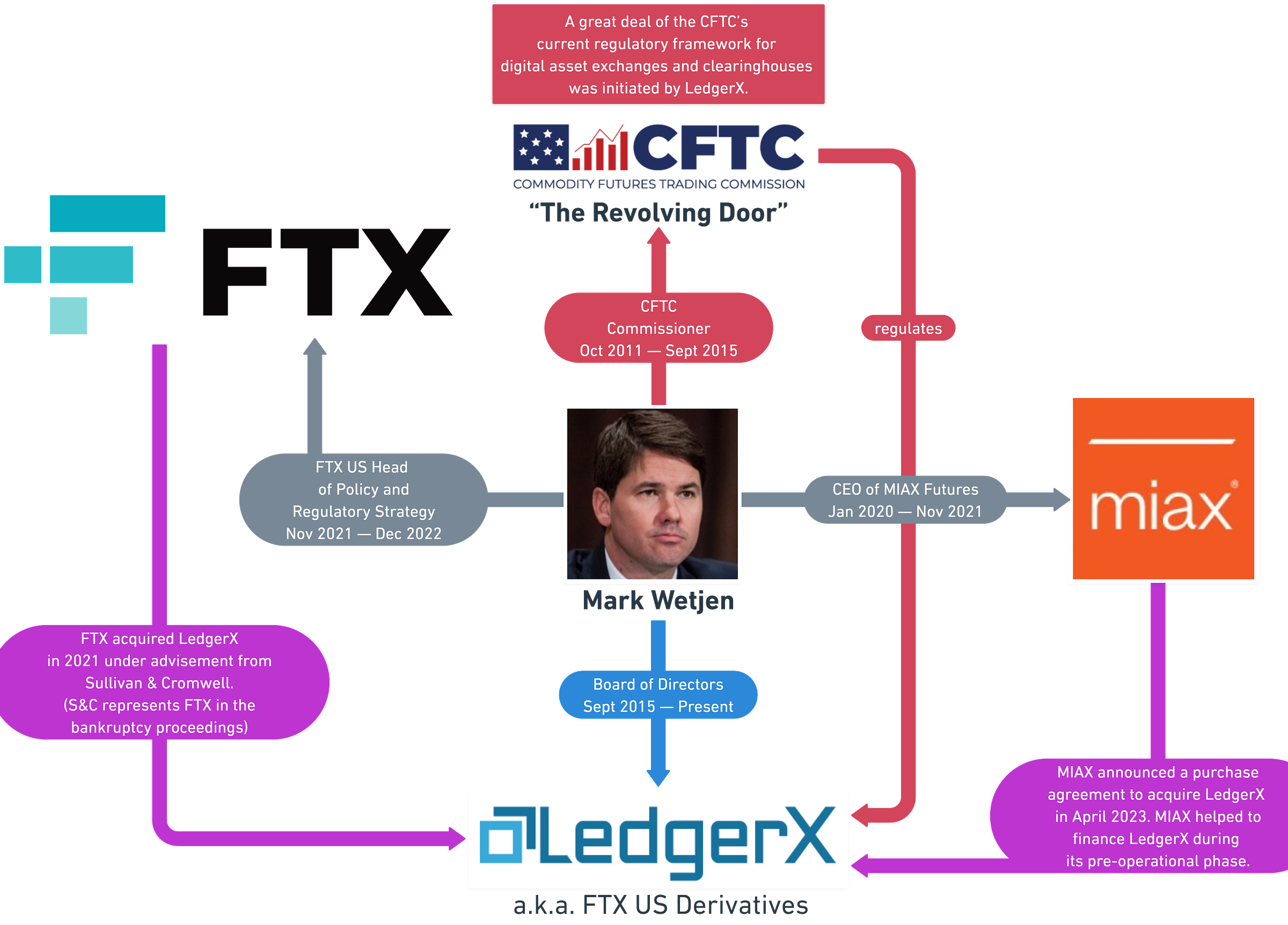

MIAX acquired LedgerX through FTX's bankruptcy proceedings. Years earlier, a director of LedgerX accused MIAX of "grossly negligent actions." Mark Wetjen was at the center of the tumultuous saga.

“The answer! Sure! We all want the answer! But HaShem doesn’t owe us the answer, Larry. HaShem doesn’t owe us anything. The obligation runs the other way.”

– Rabbi Nachtner

In January 2020, Nicholas Owen Gunden sent a letter to the LedgerX boards, shareholders, and the Office of the Inspector General at the Commodity Futures Trading Commission. The letter expressed a serious concern: that MIAX might have an intent to take over LedgerX.

Weeks earlier, the LedgerX board suspended the company’s founders in a highly controversial move. Gunden’s letter appeared about one month after the suspension.

Gunden, a LedgerX director and minority shareholder, accused the Ledger Holdings board of “grossly negligent actions towards LedgerX market participants, employees, shareholders, and perhaps even CFTC compliance requirements themselves.”

Gunden said MIAX (owned by MIH, Miami International Holdings) was the only shareholder invited to attend and participate in private board meetings. He argued that there was a lack of effort to raise funds outside of MIAX. He implied the interim director was ignoring the concerns of shareholders.

By now, Gunden’s letter seems to have been wiped from the internet.1 The traces left behind of his three-page letter paint a clear picture of two accusations: 1) the board wanted the founders out, and 2) MIAX wanted in — badly.

Allegations of Payouts, Insider Funding, and Secret Meetings

Nearly a decade ago, Juthica Chou and Paul Chou founded LedgerX under the belief that Bitcoin would be determined a commodity and fall under the regulation of the CFTC. Their hypothesis proved to be accurate. Derivatives contracts using virtual currencies ended up falling under the jurisdiction of the CFTC.

LedgerX became the first of its kind: a digital asset exchange with a DCO license and a SEF license (and later a DCM license). Through blood, sweat, and tears, the company built itself up and engineered much of the CFTC’s regulatory framework for digital asset exchanges and clearinghouses.

Despite many successes, the company hit serious turbulence in 2019, ultimately culminating in the ouster of the founders.2

After the board suspended Juthica and Paul, a petition reportedly circulated at the company in support of retaining their leadership. Two employees who filed the petition were supposedly fired in retaliation.

Although the transpiring events leading to their removal are difficult to untangle, the looming presence of MIAX was plain to see. In his letter, Gunden alleged that MIAX might have offered a board member “payouts for helping MIAX to complete an insider funding round.” At the time, MIAX reportedly held two seats on the Ledger Holdings board.

Gunden further argued that MIAX “may be seeking to benefit directly from the removal of the founders if they are able to somehow obtain implicit or explicit control of the license that LedgerX owns.”

MIH is a holding company that operates several derivatives trading platforms under the MIAX brand. Over the years MIH made a handful of major acquisitions, including the Bermuda Stock Exchange. It wouldn’t be too surprising if the company did, in fact, strongly covet LedgerX’s licenses. But was MIAX’s appetite so fierce that they stooped to the malicious initiatives alleged by Gunden?

Was MIAX really willing to gut the heart of the company in order to consolidate their power over it?

LedgerX’s interim CEO maintained that “everything” in the letter was false, although I could not locate published evidence to support his claim. Whatever went down, the company pushed forward without the founders.

Mark Wetjen’s Revolving Door

From the pre-operational phase, MIAX was instrumental to the development of LedgerX. In December 2016, MIAX became the lead investor of LedgerX. Part of their investment included a 10-year exclusive right to license for digital currency related products developed by LedgerX.

Thomas P. Gallagher, Chairman and CEO of MIH, was counting on the deal with LedgerX to provide “a huge competitive advantage” for its MIAX’s options exchanges.

And in the fallout of the founders’ departure, MIAX helped to get LedgerX a fresh injection of critical funding.

Mark Wetjen, former Commissioner and acting Chairman of the CFTC, had been at the forefront of LedgerX’s trailblazing regulatory approach. Wetjen was appointed to the LedgerX board in 2015.

In January 2020, MIAX brought on Wetjen as Executive Vice President of MIH and CEO of MIAX Futures Exchange. MIAX hired Wetjen, in part, to “act as a regulatory liaison for MIH.”

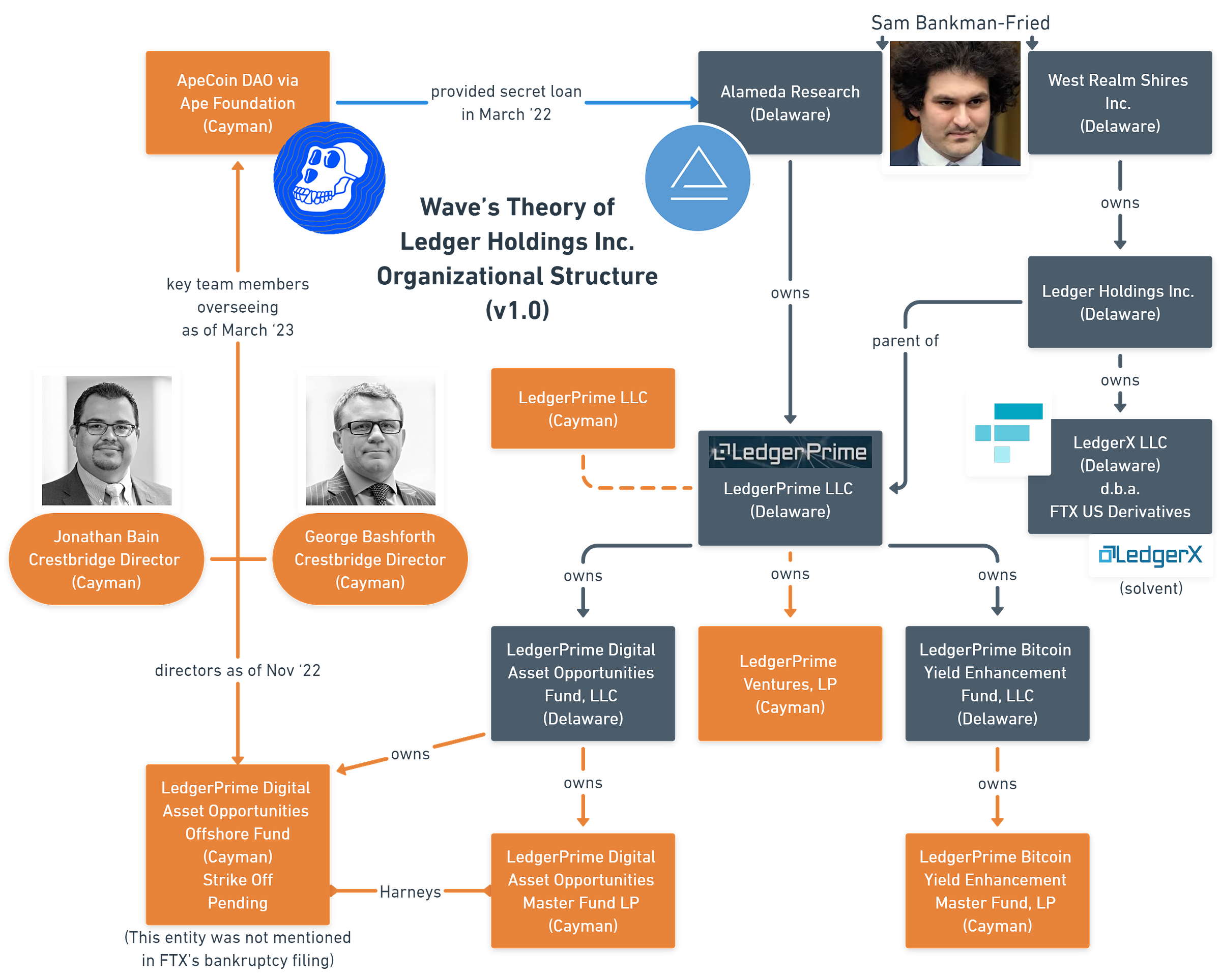

Sam Bankman-Fried understood the significance of LedgerX. In August 2021, Sam tweeted what he described as “one of the most exciting announcements” FTX ever made: the acquisition of Ledger Holdings, the parent company of LedgerX. Through this acquisition, FTX came into possession of LedgerX’s regulatory licenses, rebranding as “FTX US Derivatives.” FTX also acquired LedgerPrime, a subsidiary of Ledger Holdings.

Wetjen’s tenure with MIAX lasted just under two years. Soon after the FTX’s acquisition of LedgerX closed in October 2021, Wetjen departed MIAX and joined FTX US as Head of Policy and Regulatory Strategy.

In January 2022, FTX US Derivatives announced Wetjen would be included on the new Board of Directors.

FTX infamously collapsed just ten months later. But there was a glimmer of hope: LedgerX was one of the few remaining solvent pieces, according to the declaration of FTX’s new CEO, John J. Ray. The company was to be put up for auction. Following a series of delays, a buyer was found.

On April 25, 2023, MIAX announced a purchase agreement to acquire LedgerX as part of FTX’s bankruptcy process. Judge John Dorsey granted a motion permitting the sale on May 4.

MIAX Finally Acquires LedgerX

In April 2023, MIAX issued a press release about their proposed purchase of LedgerX. Nearly every news outlet reported the information straight off the wire with little or no further context about MIAX, Wetjen, or LedgerX’s tumultuous sales process. The actual court filings went unmentioned.

Headlines read that LedgerX had sold for $50 million, but the actual proposed sales figure was $35 million. When accounting for “cash distributions from LedgerX to the Debtors,” the total proceeds are “expected to be approximately $50 million.”

Perella Weinberg was the law firm responsible for organizing the sale. Despite receiving interest from approximately 87 parties interested in an acquisition, they failed to find serious interest from any other buyers. MIAX ended up as the only bidding party, although Perella Weinberg maintains that they conducted a thorough and fair marketing process and “successfully improved Buyer’s bid through extensive negotiations.”

For the most part, the sale seemed to close out without objection or complaint — but there was one interesting point of friction.

During the sales hearing, counsel from OKC took issue with how Perella Weinberg partner Bruce Mendelsohn characterized their negotiations.

OKC had submitted an unsolicited offer for LedgerX. A supplementary statement attached to Mendelsohn claimed OKC "refused to commit to provide" information required by CFTC. Mendelsohn’s declaration claimed that OKC believed it would not need CFIUS approval as a condition of sale. Essentially, the filing seemed to imply that OKC objected to cooperation with US regulation.

However, OKC’s attorney, Jeff Sabin, objected to Mendelsohn's characterizations as “misleading and/or simply untrue statements concerning regulatory matters related to the OKC entities."

Here’s the audio from FTX’s sale hearing (edited only to enhance the audio quality). Sabin’s comments begin around 2 minutes in:

Sabin speaks in a sharp tone in the court-recorded audio, stating firmly that at every step OKC was willing to cooperate and comply with all regulatory requirements.

The Redactions of LedgerX

It was a brief remark, but one reminder that there are many facts the public may now never know about LedgerX — including precisely how effectively it was regulated by the CFTC.

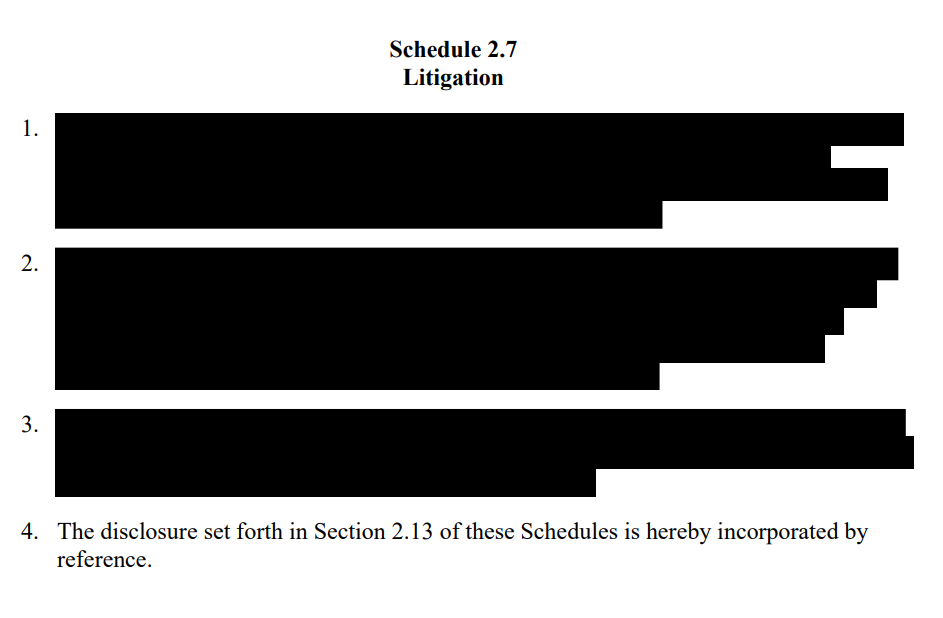

The purchase agreement contained a slew of redactions. Some parties involved in consulting, clearing services, and independent contractor agreements are redacted without explanation. Entire sections are redacted in other instances.

One key detail that jumped out in the filings: a series of tax inquiries directed towards Ledger Holdings Inc.

Schedule 2.7 (“Litigation”) is almost entirely redacted, except for the fourth item, which reads: “The disclosure set forth in Section 2.13 of these Schedules is hereby incorporated by reference.”

Schedule 2.13 covers a handful of tax issues. On November 3, 2022 — a mere eight days before bankruptcy hit — the IRS issued a request to Ledger Holdings Inc.

The IRS is currently examining their 2019 and 2020 consolidated federal income tax returns and intends to examine their 2021 return.3

On March 3, 2023, the IRS also issued a notice of examination regarding the 2020, 2021, and 2022 employment tax returns of Ledger Holdings.

The IRS later filed two separate claims against Ledger Holdings Inc.: one for $84 million filed on April 27, and one for $165 million filed on April 28.

The NY State Department of Taxation and Finance is also taking a look at their state sales and use tax records from March 2019 through November 2022. NY State filed several separate claims against Ledger Holdings, totaling over $2 million.

Strangely, another claim for $121 million against Ledger Holdings was filed on April 7, but the creditor name appears to be withheld (“Name on file”).

All in all, there might be valid reasons some of this information is redacted. Yet, given some of the disconcerting events that allegedly transpired between MIAX and LedgerX, it would have been reassuring to have had a truly independent set of eyes to take a look behind the curtains. LedgerX is one of most critical organizations in modern US regulatory history, but it’s been handled like an afterthought.

“No Collusion” (And No Independent Examiner)

LedgerX provides an important case study in US regulation, which in turn, impacts international markets in many avenues.

From one perspective, it seems only natural that MIAX ended up with the LedgerX prize. The company did make significant investments over a long period of time. John Ray affirmed that MIH is not an “insider” of the Debtors. MIAX’s Gallagher affirmed that the “Buyer and Guarantor have not acted in a collusive manner with any person.”

A skeptical perspective might raise an eyebrow at some of these issues:

Nicholas Owen Gunden issued an explicit allegations that MIAX was engaging in nefarious practices (such as offering board members payouts) in an effort to subvert the company, potentially acting negligently towards CFTC compliance requirements

Mark Wetjen serves as a prime example of the “revolving door,” as he leveraged his experience as a regulator in roles at LedgerX, MIAX, and FTX with little objection or consequence

OKC appeared to be the only other potentially truly serious bidder, and somehow their interactions led to a dispute with Perella Weinberg

Crucial details about Ledger Holdings’ operations and issues are redacted throughout the LedgerX sale agreement

The IRS suddenly took interest in the Ledger Holdings Inc. tax situation just as the FTX empire started to collapse

Last, LedgerPrime operated two separate Cayman Islands entities that were missing from Ray’s original declaration. I have a lot of questions about how LedgerPrime’s entities operated and interacted with the CFTC’s regulatory requirements.

The former director of one of LedgerPrime’s Cayman companies, Jonathan Bain, was implicated in a couple different corruption scandals. Bain is now on the administration team for ApeCoin DAO, which has been covering up a series of backdoor agreements with Wintermute. Bain’s team follows another Cayman administrator that sent roughly $10 million to Alameda in the form of a secret “loan.”

Altogether, there are more than a few red flags. The CFTC exists to promote the integrity, resilience, and vibrancy of the U.S. derivatives markets through sound regulation. Is that happening?

LedgerX and LedgerPrime presented a rare opportunity to step back and develop an honest evaluation of exactly how effectively the regulators acted in respect to LedgerX and LedgerPrime. An investigation by a genuinely independent party would have shed great insight. Are the regulators acting in the interest of the public, safe and fair markets, and “sound regulation”? Or did some succumb to a carnivorous circle of private interests?

There is no independent examiner for FTX, and there was no true examination of the regulatory history of LedgerX.

Instead, a big orange hand showed up to sweep away everything — the good, the bad, and the ugly.

The letter was published on CoinDesk, but it was removed from the hosting service. I reached out to the author of the article, Nikhilesh De, to see if he could provide a copy of the letter. He did not respond to my requests. Information included in this story about Gunden’s letter was pulled from the CoinDesk article and other contemporaneous media reports.

It’s a long but important story. Another time.